By Oregon Small Business Association

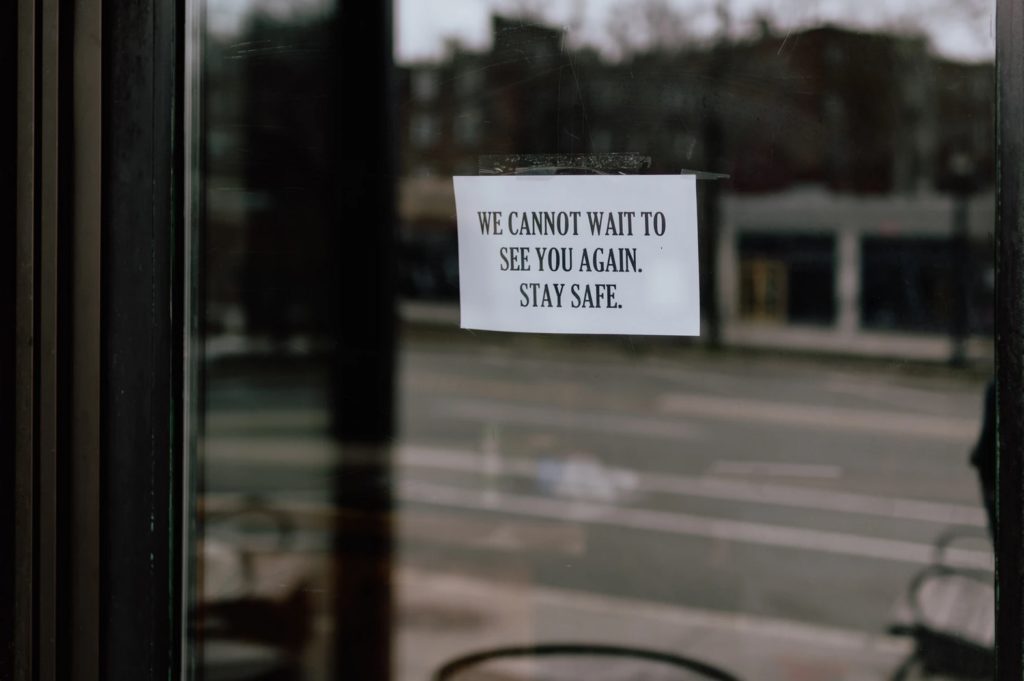

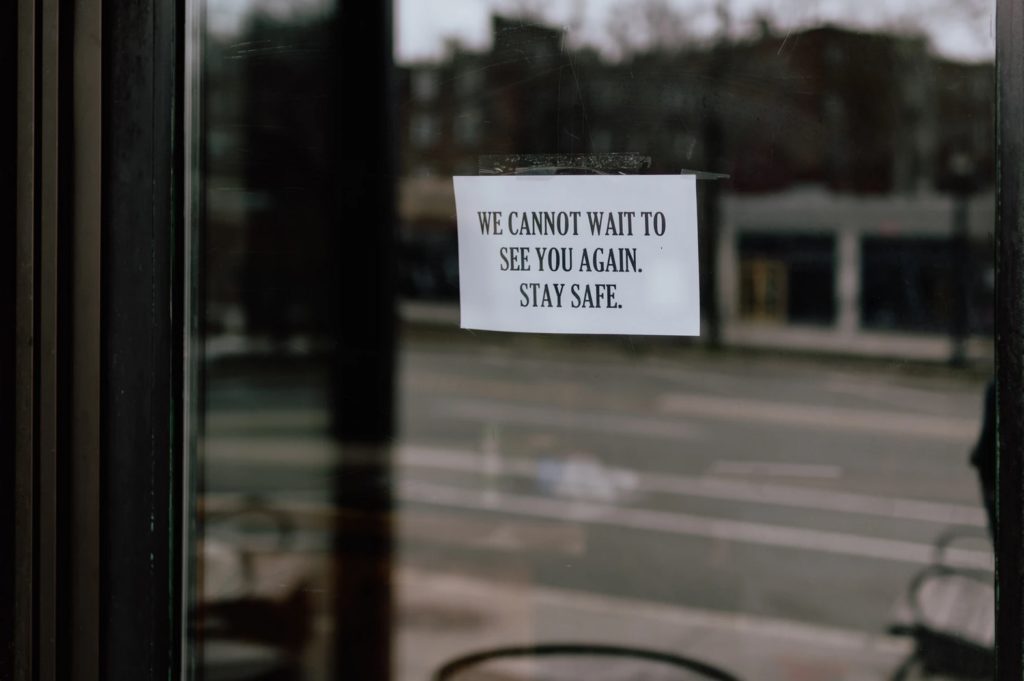

Although Multnomah County restaurants area can reopen to serve customers indoors, many owners and operators hesitate to invest in rehiring workers and restocking kitchens when a spike in coronavirus cases could force them to shut their doors again. The uncertainty for restaurant owners, who have been forced twice in the past year to close to indoor dining, has them wondering whether they’ll earn enough by serving a reduced number of customers to cover their expenses, according to the Portland Business Journal.

Gov. Kate Brown stated that Multnomah, Washington, and Clackamas counties are all now at the moderate risk levels, meaning they can soon boost indoor dining capacity to 50 percent.

Annie Cuggino, chef at the high-end downtown Q restaurant, recently opened the restaurant for the third time. Rather than reopening now, the owners of Le Pigeon and Canard plan to keep operating in a popup tent at the Jupiter Next hotel until April. As case counts keep plunging and vaccinations increase, they’ll hire and train workers and then reopen as long as it’s safe for both customers and employees.

The owners of Holler, Bullard and Abigail Hall restaurants won’t reopen until it’s safe and, noting the slim margins in the restaurant business, want to make certain limits on seating will enable them to cover all their costs. They said they can’t justify the expense of opening a 70-seat restaurant at 25 percent capacity. They might survive at 50 percent capacity, but they don’t want to lay off employees again if the state orders another shutdown.

The RingSide restaurant created a backup plan to reopen the dining room gradually while continuing to fulfill to-go orders. The restaurant also has created an outdoor dining area to use if the state orders more closures.

Vanessa Preston, owner of Café Nell, told KPTV said her restaurant is ready for whatever happens, taking safety measures, limiting the number of customers, and sanitizing each table after every use.

Olympia Provisions nearby isn’t allowing customers inside the restaurant but only outside or in the atrium until all staff members are vaccinated. Executive chef Katherine Roe said they’re keeping maskless people away from their employees.

Although Multnomah County restaurants area can reopen to serve customers indoors, many owners and operators hesitate to invest in rehiring workers and restocking kitchens when a spike in coronavirus cases could force them to shut their doors again. The uncertainty for restaurant owners, who have been forced twice in the past year to close to indoor dining, has them wondering whether they’ll earn enough by serving a reduced number of customers to cover their expenses, according to the Portland Business Journal.

Gov. Kate Brown stated that Multnomah, Washington, and Clackamas counties are all now at the moderate risk levels, meaning they can soon boost indoor dining capacity to 50 percent.

Annie Cuggino, chef at the high-end downtown Q restaurant, recently opened the restaurant for the third time. Rather than reopening now, the owners of Le Pigeon and Canard plan to keep operating in a popup tent at the Jupiter Next hotel until April. As case counts keep plunging and vaccinations increase, they’ll hire and train workers and then reopen as long as it’s safe for both customers and employees.

The owners of Holler, Bullard and Abigail Hall restaurants won’t reopen until it’s safe and, noting the slim margins in the restaurant business, want to make certain limits on seating will enable them to cover all their costs. They said they can’t justify the expense of opening a 70-seat restaurant at 25 percent capacity. They might survive at 50 percent capacity, but they don’t want to lay off employees again if the state orders another shutdown.

The RingSide restaurant created a backup plan to reopen the dining room gradually while continuing to fulfill to-go orders. The restaurant also has created an outdoor dining area to use if the state orders more closures.

Vanessa Preston, owner of Café Nell, told KPTV said her restaurant is ready for whatever happens, taking safety measures, limiting the number of customers, and sanitizing each table after every use.

Olympia Provisions nearby isn’t allowing customers inside the restaurant but only outside or in the atrium until all staff members are vaccinated. Executive chef Katherine Roe said they’re keeping maskless people away from their employees.

Subscribe To RSS

Subscribe To RSS